Analysis sent out every Monday

Build with Axial: https://axial22.axialvc.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

Bispecifics are probably the fastest growing category in biologics. They merge 2 antibodies with different target specificities into a single construct. The field’s start coincided with Genentech’s rise. As monoclonal antibodies began to have clinical success, new technologies emerged to make bifunctional biologics. Paul Carter played a central role in the development and success of bispecifics. Coming out of Cambridge in the UK, he started off his career at Genentech in 1986. Initially Paul worked on antibody humanization that led to several approved medicines. Then in 1996, already promoted to leading his own group, Paul and his collaborators published their knobs-into-hole technology. This became a foundational tool in bispecifics helping the field move from a molecular lottery to a predictive process. Paul left Genentech only to come back in 2010, and a year later, Roche published work on CrossMab, that built upon the knobs-into-hole concept, to generate a more diverse array of bispecifics.

While Paul’s story established the key technologies for bispecifics, on a separate thread, Patrick Baeuerle was working toward the first clinical success. Patrick was the CSO of Micromet (acquired by Amgen in 2012) and led the development of Blincyto, the first approved (2014 in r/r ALL) bispecific drug. He trained in the Baltimore Lab at MIT discovering new subunits of NF-κB. And shortly afterwards became a professor in Germany. He left to join Tularik in 1996. Then Patrick joined Micromet, a company colleagues from Germany founded, two years later. Part of his job initially was to help the company pivot from diagnostics to drug development; Micromet was working toward in-licensing a monoclonal antibody but once the deal fell through, the company moved to license a T-cell engaging bispecific (still a relatively new area in drug development) from LMU Munich, which ultimately became Blincyto. Now there are over 80 bispecifics in clinical trials and probably well over 20-30 technology platforms out there. With 8 of the 10 highest grossing drugs biologics, over 80 mAbs approved, and 20-something biologics commercially launched last year, bispecifics are positioned to treat more patients over the next decade. Paul, Patrick, and the groups they led set the foundations for the field:

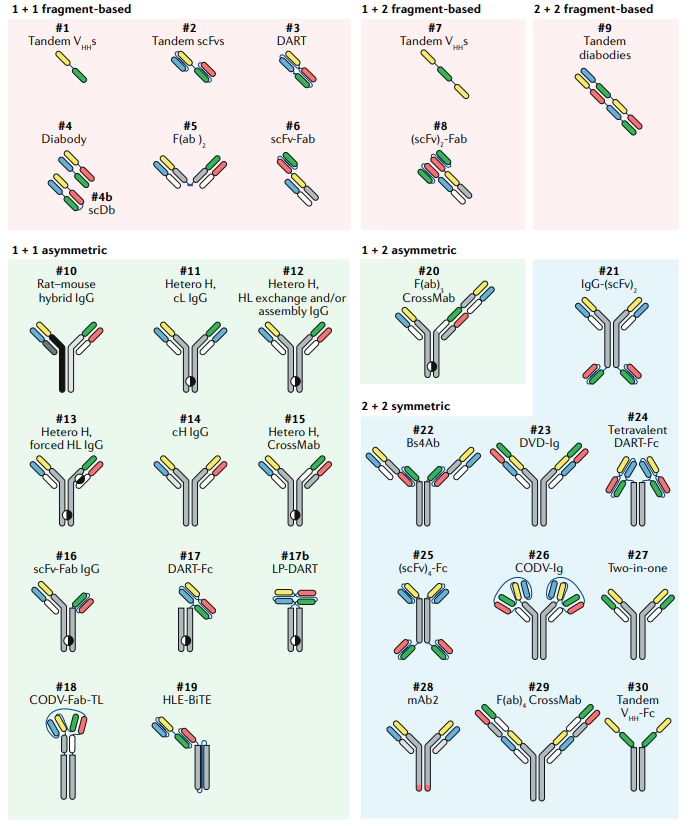

“There are more different ways to make bispecific antibodies than flavors of Ben & Jerry’s ice cream. We’ve gone from an era where bispecifics are limited by the technology to make them efficiently to an era where they’re only limited by our imagination.”

Discussed in previous analysis, the first bispecific technology, Quadroma, came out during the 1980s. It relies on fusing 2 hybridoma cell lines to merge distinct heavy/light chain pairs. This process was really messy because 16 different combinations of a bispecific can randomly be generated from the 2 heavy and light chains. Over the last few decades, protein engineering has become more and more sophisticated. Enabling the specific pairing of certain chains and potentially seamless mixing and matching with minimal modifications.

CrossMab, one could argue this is the best bispecific technology in the world given its history and advantages around stability. The technology is centered around a knob-into-hole premise to engineer the chains of different antibodies to bind each other (i.e. simply changing amino acids to create a hole and another one to bind it). The key part is to avoid chemical linkers which could lead to aggregation and poor stability as well as keeping an IgG structure. The tradeoff here is to reduce potential complexity of a CrossMab.

BiTE has a clinical approval with Blincyto. The format relies on a single polypeptide chain to bring different fragments together - this increases antigen recognition but could lead to higher rates of aggregation. This technology goes beyond IgGs by removing the use of an Fc segment to potentially reduce T-cell overactivation and increase tumor permeability, which comes with relatively short half-lives and multiple/continuous dosing.

DART = dual-affinity re-targeting antibody. From MacroGenics, a DART biologic is created from switching VH domains from 2 Fv fragments. The premise is that this process creates an interaction that is found within the larger IgC molecule and leads to lower rates of aggregation.

VelocImmune from Regeneron. Although not completely focused on bispecifics, it is a world-class technology to produce fully human antibodies in vivo.

The bispecifics generated from these technologies can block two signaling pathways at the same time, block multiple immune checkpoints, and even force the association of protein complexes. Given the history, Genentech and Amgen are naturally the dominant companies within bispecifics. But over the last 2 decades, a large set of new platforms have emerged:

F-Star Therapeutics: introducing new binding sites to antibody backbones

Teneobio: platform to decouple tumor cytotoxicity from cytokine release

Adimab: yeast humanization

Genmab: DuoBody technology to express 2 separate antibodies and in vitro, are separated and reassembled to retain the manufacturing advantages of mAbs

Shattuck Labs: binding 2 targets in a multivalent way, where currently approved bispecifics only do monovalent binding

Xencor: XmAb platform to optimize Fc domains for cytotoxicity, antigen-binding, among others

Numab: technology to engage >2 targets

Harpoon Therapeutics (founded by Baeuerle): TriTACs to sidestep the need for MHC recognition to kill cancer cells

F-Star has an exciting platform, which was covered in past work. The company is probably underselling itself given the potential of their technology to generate building blocks for existing bispecific developers. Teneobio is also fascinating given their ability to effectively sell themselves 3 times and still have an operating company left over. Teneobio is centered around their UniRat technology - a triple knockout rat where native expression of variable and heavy/light chains are inactivated. This enables transgenic expression of the full human VDJ repertoire in the rat model. However, the transgene for the heavy chain variable domain is linked to a conserved rat Fc, which allows a normal antibody response with heavy-chain-only antibodies (UniAbs, 80 kDa versus 150-160 kDa for IgG).

UniAbs form a smaller version of an active antibody fragment and are an ideal building block for bispecifics given the minimal engineering required for heavy/light chain pairing, a common theme for current platforms. With the ability to generate large panels of UniAbs, Teneobio focused on building a library of anti-CD3 (a T-cell marker) molecules covering low- to high-affinity binders. The company’s value was its ability to match a CD3 UniAb to a specific level of T-cell activation and control tumor cytotoxicity (maximize efficacy) as well as cytokine release (manage toxicity). This expands the therapeutic window for their drug candidates. There is an opportunity to do similar work for CD28, CD16A, to engage gamma delta T-cell targets, among others. The company recently sold itself to Amgen in 2021, while spinning off 3 NewCos. Teneobio is the archetype for the current generation of bispecific companies - creating high-affinity binders is no longer enough, companies need to optimize bispecifics for toxicity and dosing that has limited their current use.

Due to these limitations, bispecifics may only be venture-scale for rare cancers. And development for larger indications will be done by or with biopharma. Given they are a single therapeutic that consolidates multiple immune functions, the modality is a potential way to to sidestep, or at least bridge to cell therapies. But bispecifics are still complex proteins that require thoughtful design and took decades of engineering to begin having an impact on human disease.

Blincyto, bringing CD3 T-cells to CD19 ALL cells, has an impressive ORR > 60%, but its design (i.e. small size & no Fc region) reduces its half-life and limits its use to continuous infusion. As a result, bispecifics really only have advantages in the least fit patients right now. Versus CAR-T cell therapies, bispecifics are immediately available versus weeks turnaround time and easier to titrate but cannot be used with a single infusion. Until high-stability bispecifics show more success in the clinic with a daily or weekly dosing schedule, the modality will play an important role in controlling disease for a certain window until a transplant becomes available but have struggles expanding to new treatment lines.

To realize the original dream of bispecifics hatched in the 1960s, figuring out ways to compose biologic building blocks for IgG-like backbones that both generate a therapeutic effect (target engagement, cell killing) and control toxicity/side-effects is needed. Better linkers and more control over bispecifics are improving year-after-year. In a decade or so, likely 2 to 3 bispecific technologies that solve these problems will only endure. There’s a whitespace using genomic tools to explore human immunity discovering new bispecific building blocks - a Guardant Health for biologics. The Teneobio model is still viable for other immune-cell targets. Even nanobodies, led by Ablynx/Sanofi, are small, intact antigen-binding fragments that can potentially be mixed-and-matched with other backbones. Building blocks for bispecifics are an interesting way to build on top of existing platforms and allow companies to focus on particular domains. Teneobio did very well focusing on a CD3 library. And F-Star had a lot of potential with their Fcabs. There’s so much more to do here though for current companies as well as new startups. There are also a ton of opportunities to map out platform technologies in biotech and build on top of them rather than compete directly.

On one side, minimal engineering is the value prop to avoid potential toxicity and dosing issues later in the clinic. On the other side, complex engineering creates a zoo of biologics to choose from. Interchanged with existing biologics or used to create new ones, they can be used as monospecific antibodies themselves, and even be used in ADCs. Bispecifics are also being found to help re-engage CAR-T cell therapies and increase the efficacy of past treatment regimens. Over the last 4 decades, bispecific development has grown in spurts: technological success met clinical failure & clinical success met challenges with tolerability. Now new building blocks and models are emerging to standardize bispecific development to the level of monoclonal antibodies (mAb) and expand their number of applications.