Axial: https://linktr.ee/axialxyz

Axial partners with great founders and inventors. We invest in early-stage life sciences companies such as Appia Bio, Seranova Bio, Delix Therapeutics, Simcha Therapeutics, among others often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you - email us at info@axialvc.com

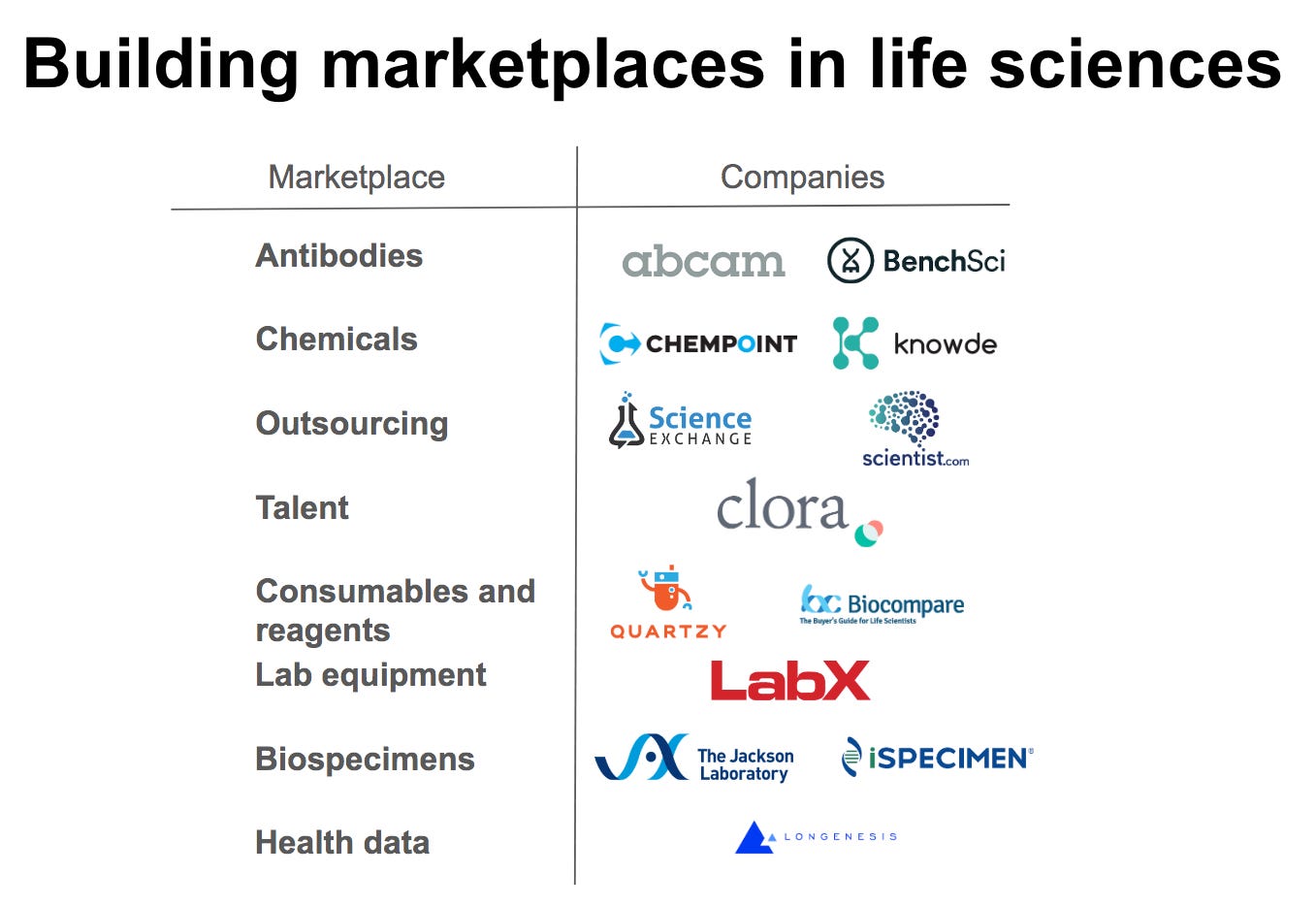

In life sciences marketplaces, antibodies and chemicals are the dominant markets. However, there are other segments that are either established or emerging where a marketplace can bring significant value: outsourcing, talent, consumables and reagents, lab equipment, health data, biospecimens, among others.

Outsourcing

As drug development became more virtualized in the early 2000s accelerated by large biopharma reducing their R&D footprints and opening up facilities and campuses to become contract research organizations (CRO), outsourcing experimental work has become feasible. This has created a window for outsourcing marketplaces like Science Exchange, Scientist.com, and others to emerge.

These marketplaces allow companies to find R&D services from CROs, research labs, and other groups. The key issue for any life sciences outsourcing marketplace is trust and confidentiality. Science Exchange has done a really great job to solve both of these problems: the company gives a performance rating for each provider based on reviews and has pre-established NDAs and contracts with providers to protect the confidentiality of customer data. Another important feature for Science Exchange is not allowing email sharing to maintain protection of customer data. Ultimately, the customer workflow starts at search where a good marketplace has a broad enough portfolio of service providers along with quotes to get to a purchase. Post-transaction, products for project management and payments are pretty important as well.

Some key parts out an outsourcing marketplace are:

Product portfolio - in life sciences, having services providers spanning analytical chemistry and affinity maturation to flow cytometry is important for price discovery, friction reduction, and customer growth. A good analogy for outsourcing is a catalog or a bulletin board.

Suppliers - Science Exchange has over 2500 providers and over 7000 services. Scientist.com has over 3000 providers. Standardization of services is important along with building a network of experts; Science Exchange has built out the equivalent of a concierge service to navigate providers.

Customers - finding beachheads with applications seems like the winning strategy. Most of these marketplaces started off with low hanging fruit in small molecule screening and grew from there. There are often a lot of cross-selling opportunities in R&D labs - if you’re screening a small molecule library, you probably will need medchem services.

These outsourcing marketplaces enable a capital-lighter biotechnology. Companies and labs can avoid buying equipment, at least early on. However, reproducibility and control of the experiments are risks. Some like Emerald Cloud Lab and Transcriptic (now Strateos) are marketplaces in some sense where the customer can control the experiment. Overall, the concept of the virtual CRO has a chance to come to fruition over the next 5-10 years. Similar to Shopify, service providers and labs could set up their own storefront and help customers without having to buy facilities themselves. With this, what is the drop shipping equivalent in life sciences? For outsourcing marketplaces, there are growth opportunities to focus on biologics and cell & gene therapies along with synthetic biology, devices, and diagnostics.

Talent

Marketplaces for talent in life sciences are also an emerging field. Clora is the leader in the field. The company helps match consultants running from accounting to R&D to companies. A company posts a project and Clora recommends 3 candidates. Clora also acquired Legit to add on paid messaging to experts; Legit said they had over 2M experts on their platform.

Some key parts out a talent marketplace are:

Product portfolio - talent is the product here. It seems like success is driven more by social drivers than anything else. If a BD consultant sees a friend use Clora to find projects, then they’re probably going to jump into the marketplace themselves. Other features like scheduling, payments, compliance, and data security are very important to build moats.

Suppliers - one word: talent. Another important feature are ratings and categorizing talent by capabilities.

Customers - this might be the easier part to get on board. Companies across the board face challenges with hiring.

Talent marketplaces here face significant headwinds from LinkedIn. There are opportunities to build focused marketplaces for life sciences executives, a search engine on biotech researchers, and regulatory resources/consultants.

Consumables and reagents

Consumables and reagents (C&R) are a natural fit for a marketplace. Quartzy helps with discovery and management of these resources, Zageno offers a wide range of reagents, and Biocompare is like a Craigslist for life sciences. Quartzy has a great product with over 100K customers and over 1K product suppliers. The company’s product uses their lab management software to get users onto their marketplace. The key part is that access to the marketplace is free for users and suppliers pay a fee to market their products on Quartzy.

Some key parts out a C&R marketplace are:

Product portfolio - getting breadth here is pretty straightforward since consumables and reagents are more-or-less commodities. There are other opportunities to build peripheral products similar to Quartzy to act as a funnel for new users.

Suppliers - more of a commodity for marketplaces. Vendor ratings are important here too.

Customers - since C&R can be bought almost anywhere, finding unique ways to acquire users in an efficient way is necessary.

Marketplaces in the C&R category can span CRISPR and PCR products to extraction and library prep kits for sequencing. There are many tiny niches to start, but customer acquisition is pretty hard. Once a beachhead can be secured, there are opportunities for these marketplaces to sell their own internal products given they have all the buyer/seller data.

Similar to C&R, lab equipment is a natural fit for a marketplace model. Scientific equipment, devices, and even software packages Lab and Process is a leader here. Health data is an emerging field for marketplaces. HealthVerity, Longenesis, and Dawex have all made pushes to become the Acxiom for healthcare and life sciences. Data marketplaces have very low friction once that information is uploaded. For example, a biopharma company can query for patient data for a specific target. 23andMe could easily launch this type of marketplace if they wanted to. Marketplaces are also useful for biospecimens like mouse models and human tissues. The Jackson Laboratory is essentially an island full of thousands of different mice variants in Maine. iSpecimen and Precision Medicine Group also help scientists gain access to tissues and stem cells that are stored in various healthcare organizations such as biobanks and hospitals.

Marketplaces are very powerful business models for price discovery and scale in life sciences. The Internet hasn’t really made its way to many parts of drug development and life sciences research. There are windows to build marketplaces for enzymes, CRISPR reagents, executive coaching, cell lines, and even supplements.